How to Get Your Finances Back on Track

The Intentional Mom Planning System is where you need to start with our incredible collection of product options. It will help you establish the basics for your life & home so you’ll finally have a plan, save yourself time, and go to bed feeling like you accomplished something every day (because you did). Save up to 60% HERE!

This is a sponsored post with The Huntington National Bank and The Motherhood. All opinions

are my own.

I’m not sure about you, but sometimes it can be hard to stick to “the plan.” For me, this happens

at times when I’m trying to stick to my daily plan and schedule and the day just goes haywire,

but that’s not all. Maybe like me, you also find it hard to stick to the spending plan, the budgeting

plan, or the savings plan. Because let’s face it, sometimes it’s just more fun to spend money on

whatever shiny object comes your way. Sometimes it’s nice to upgrade your old phone to a new

one. Other times it’s nice to treat yourself to a new outfit. Yet other times it becomes necessary

for your mental health to take a couple of days away. But then, it’s time to reel things back in.

There comes a time when you’ve got to get back on track. There’s a time when you must just

get back to the plan. You’ve got to start paying attention to what you’ve planned to spend, what

you’ve planned to save, and making your financial goals happen. So then, how do you get your

finances back on track?

Before we really get started, I think it’s important to note a few steps to take first.

Dump the guilt

Maybe you’ve not done great with your money these past few months. Maybe your summer was

filled with a lot of fun and not a lot of sticking to the budget. It could be that you experienced

some unexpected expenses. For me, I found myself having to dip into my emergency fund to

pay for some extra dirt for a landscaping project in my yard. Like so many times, what we

thought was needed just wasn’t enough.

While it’s easy to feel guilty that I haven’t put money back into my emergency fund to replace it,

I recognize that there have been other places the money has been needed.

Plus, I could have been a bit more diligent in watching our spending, but I wasn’t.

If you find yourself dumping on the guilt that you didn’t focus on your money plan sooner, now is

the time to stop.

Guilt accomplishes nothing good.

Let go of the past

If you’ve made some money mistakes in the past, today is a new day. It’s important to let the

past be the past. We all do things that we wish we wouldn’t have done once we get the

perspective of hindsight.

Before you can move forward, just accept whatever money mistakes you’ve made and then

leave them in the past.

Look forward

As I mentioned above, today is a new day. With the past officially behind you, now is the time to

get really excited about where you’re going in the future.

I find this is always one of the most exciting things about making mistakes.

Learning from mistakes and putting them behind you is a pretty exciting thing if you embrace

them as the springboard to moving forward.

And with that, let’s talk about how to get your finances back on track!

Revisit your budget

Let’s face it, times change. What you were spending a few months ago could very well have

changed. This is especially true if you’ve not really been paying very close attention to your

spending lately.

To get your finances back on track, track your spending habits and come up with a new budget

that is reasonable, yet one that challenges you.

Huntington Bank makes tracking your spending so simple with their Spend SetterSM tool, which is

included in your online banking access from The Hub.

This intuitive tool will even make budgeting suggestions based on your spending habits. It’s kind

of like having your own personal financial advisor in your pocket.

Update your financial goals

Financial goals show you where you’re going and what you need to be reaching for. Once you

know these things, you can come up with the first few steps you need to take in order to get

there.

Now is the perfect time to revisit the goals you’ve set, change them up, or maybe you’ll even get

rid of some goals and make new ones.

Getting back on track with your finances means you’ll want to make sure you know where you’re going and how you’ll get there.

Focus on the essentials first

When it comes to the essential with your money, there are a few things you’ll want to make sure

you’ve got in place:

A fully funded emergency fund. An emergency fund is money earmarked for emergencies in

your savings account.

You can read more about that HERE.

Debt reduction plan. It’s really hard to move forward when you’re constantly being pulled

backwards by your debt. When getting your finances into shape, you must also include a plan to

start paying off some debt.

Regular savings deposits. Accomplishing your financial goals will likely only happen if you’re

regularly putting money into savings aside from your emergency fund savings.

Getting and staying out of debt can only happen if you’re saving for the things you buy. Waiting

to buy things until you can afford them rather than going into debt to buy them before them is

smart money management.

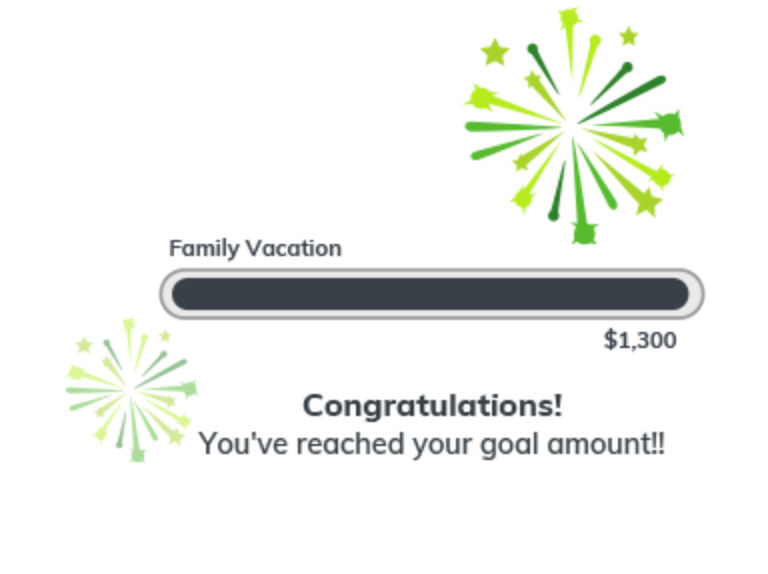

Huntington Bank’s Savings Goal GetterSM tool can help you get this done faster. Using this tool,

you’ll be able to check in on your goals easily and quickly, know if you’re on track or need to focus on changes.

Prioritize the rest

Once you’ve got your budget emergency fund, your debt reduction plan, and regular savings

deposits all in place you’ll want to prioritize the rest of your money.

When you’ve got all the bills paid, your emergency fund in place, a good start on paying off

debt, and are making deposits into savings for expenses on the horizon, what happens with any

money you’ve got left over?

Planning how you’ll spend every dollar is ideal, so now is the perfect time to map that all out.

Getting your finances back on track means you’re choosing where everything is going. A good

portion of your incoming money will probably always go towards living expenses, other things

like education, and debt you need to pay back, but don’t let any other money slip through your

fingers unnoticed.

For most us us, extra money always gets spent. And, it’s really easy to have no idea where it all

went if you’re not following a plan of where it will get spent ahead of time.

This is what makes Huntington’s Spend SetterSM such a valuable tool.

Commit to making better decisions

Getting your finances back on track means you’ve likely made some money decisions that

weren’t really all that great. But once you’ve worked through all these steps, you’ll be ready to

move forward.

This starts with a commitment to make better decisions.

If you find yourself in need of getting your finances back in shape, it just means its time to start

making progress one step at a time. It doesn’t take much to start moving the needle in the right

direction, and with the perfect tools from Huntington Bank, it’s never been easier.