Why a Savings Account Is NOT An Emergency Fund

The Intentional Mom Planning System is where you need to start with our incredible collection of product options. It will help you establish the basics for your life & home so you’ll finally have a plan, save yourself time, and go to bed feeling like you accomplished something every day (because you did). Save up to 60% HERE!

This post is brought to you by The Huntington National Bank and The Motherhood. All opinions are my own.

Do you have an emergency fund? Maybe you know you need an emergency fund but haven’t ever been able to make getting the money you need set aside in an emergency fund. There always seems to be something more pressing that demands to be paid, at least for most of us. The thing is, unplanned expenses are a reality for nearly all of us at times, and this is exactly what an emergency fund is for. But, what is the difference between a savings account and an emergency fund account? Honestly, there’s a big difference between the two. I’ll not only be explaining the difference between the two, I’ll also share some ways you can get some money into your emergency fund right now, even if you’re starting from zero.

Some background.

Let me give you a little background on why I am so passionate about every single person having

an emergency fund in place. When my husband came home in the middle of his shift and told me he had lost his job, the panic set in immediately. With a large family to support and his income paying 90% of our expenses, it was impossible not to feel the wave of fear wash over me.

Once the dust settled, the panic eased some when I reminded myself that we had an emergency fund in place for just this moment. I knew we had enough money in our emergency fund to buy us some breathing room while we figured things out and to fill in the gaps when we were short while moving forward again.

The feeling of security that our emergency fund provided is exactly why it’s so important for everyone to have an actual emergency fund, not just a savings account.

Think about it – what would you do if your income went away tomorrow?

Tomorrow.

But, what’s the difference between an emergency fund and a savings account?

How a savings account is different from an emergency fund

A savings account is non-specific. A basic savings account is a place to collect money for the things you’d like to buy or know you will need to buy someday.

The money you have in a savings account will almost always be spent on something that you choose to buy or pay for.

Simply put, a savings account is for expenses that are planned.

So then, what is an emergency fund?

An emergency fund is an account with money saved that will be used only for unexpected expenses. An emergency fund is a safety net for the curveballs that life tends to throw at us all.

A true emergency doesn’t have to be something as large as job loss. But, it could be things like a broken furnace, a huge medical expense, a car accident that totaled out a car, or home damage that insurance didn’t cover.

While I can’t fully define what an emergency would be here in this piece, I will say that something qualifies as an emergency only after you are certain that you can’t make it, make due with what you have, or do without whatever you’re looking at spending money on.

For example: a broken washer that would cause you to either have dirty clothes or cost you hours of your time and the added expense including for the gas to drive to a laundromat might very well be an emergency.

In contrast, buying a new shirt because you don’t want to show up to the same event wearing the same top wouldn’t be an emergency. While you might not like wearing the same top, it is something you can do without.

Sorry, but it is.

Now that we’ve talked about the difference between an emergency fund and a savings account, let’s talk about how to get money into an emergency fund STAT.

How to build an emergency fund from zero

First, I’ll need to share how you can get your hands on the tools that I’ll be mentioning.

As an ambassador for Huntington Bank this year, I’ve been using a couple of tools that make it so easy for you to save money no matter your income level.

In order to come alongside their customers when it comes to saving money, Huntington has created digital tools that will change the way you save money.

The Hub

The Hub features a variety of tools and is like a financial toolkit to help you manage your money better and in a more visual way that makes dealing with money easier to understand.

Savings Goal GetterSM

Like the name says, this tool makes accomplishing the things you want your money to accomplish easy, visual, and even fun. When using the Savings Goal Getter, you can easily see what you’re saving for. This is huge motivation to stay the course in making your dreams and goals become a reality.

Not only that, Savings Goal Getter will make personalized recommendations for what your emergency fund might need to look like. This intuitive tool will also tell you how you can save even more based on how much you choose to save.

Here are six ways you can build up your emergency fund

Get cash & build your emergency fund

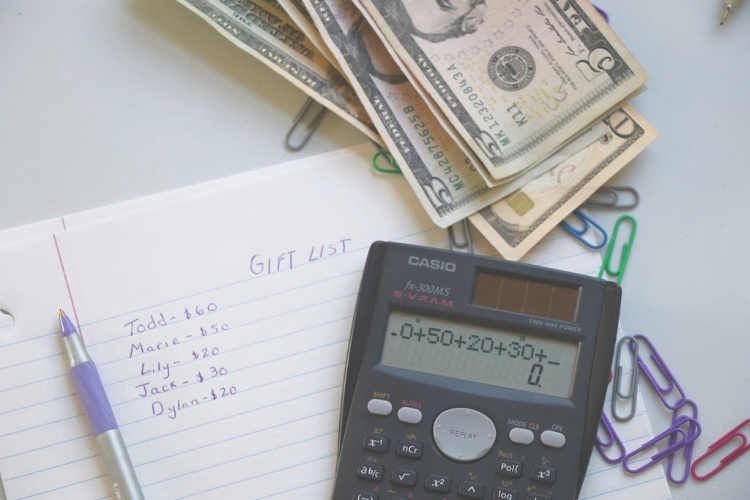

If you are taking out cash regularly from your checking account for your everyday activities, consider taking $5-$10 less than usual and transferring it to your savings account instead.

Even if it’s only $5, consider transferring it to your emergency fund.

Think of how painlessly you spend $5 on random things. Most of us think nothing about dropping $5 on a coffee or even $10 on snacks from the concessions stand at the ballpark.

Dinner out for a family of four is easily more than $40 with a tip.

By painlessly spending this money on you (putting it in your emergency fund), you’re building your emergency fund without even feeling it.

Take advantage of rewards programs

I do this in a few different ways. I use a credit card with cash rewards for many of my expenses, and once a year I cash in the rewards. If you did the same thing, this is money you could put directly into your emergency fund.

Of course, this only makes sense if you’re paying your credit card off in full every month.

Tighten the belt

Let’s face it, most of us can tighten the belt in a few areas. In some cases, more than just a few areas.

If you commit to shopping for cool but unnecessary stuff less and put that money into your emergency fund instead, you’ll be making progress.

If you choose to not eat out for an entire month when you would normally do this once or twice a week, think of how much money you could be putting into your emergency fund.

Using moderation in a few areas where you commonly indulge can really get your emergency fund rolling.

Sell some stuff & put the profits in your emergency fund

If you hear this and your skin starts to crawl, know you’re not alone. I have a hard time parting with things, too, at least initially. But for most of us, we’ve got homes filled with things we never or hardly use. These are things you can sell to get some money in your emergency fund.

The bonus is that you’ll also have less stuff, which is usually a very good thing for all of us.

Increase your income

I’ve got a friend who picks up seasonal work at a greenhouse during the summer. She does this specifically because she uses the money she earns to pay for all of her kids’ activities for the entire year. You could do the same thing to build up your emergency fund.

There are even plenty of online projects and work to be found these days so you can earn money right from home.

Even if you’re only doing this until your emergency fund is in place, you will have accomplished this so much faster than you would have otherwise.

Figure out a way to increase your income, if only for this season of emergency fund building, and put the extra money into your emergency fund.

Create a budget

Those who create and live by a budget often spend less money than those who don’t. It’s amazing what an eye-opening experience creating a budget can be, especially if you’ve never created one before.

But, Huntington is there to help with this, too.

In addition to their other slick tools mentioned above, The Hub also has Spend Analysis, which allows you to see an overview of your spending by category.

As a Huntington customer, I can say with certainty that this is the single best thing that can happen to your money. Spend Analysis allows you to keep focus on where you’re spending and on what, so you can adjust your spending or adjust your budget at a quick glance.

No more spending surprises when you can see where all your money is going by category in a matter of a moment.

When you meet your budget goals, this can help you meet your spending goals rather than having to cough up the extra money to cover that new phone you just bought.

This all means you can also meet your savings goals, including saving for your emergency fund.

After meeting with customers in their own homes, Huntington learned firsthand the information they needed to create these amazing tools that can make saving for an emergency fund easier than it has ever been.

No one likes to think about the unexpected or unthinkable happening, but there is nothing like knowing that you’ll have a plan already in place should that happen.

This is truly priceless to me, that Huntington is there to help.