How You Can Afford the Life You Really Want Even If You Think You’re Broke

The Intentional Mom Planning System is where you need to start with our incredible collection of product options. It will help you establish the basics for your life & home so you’ll finally have a plan, save yourself time, and go to bed feeling like you accomplished something every day (because you did). Save up to 60% HERE!

This post is brought to you by The Huntington National Bank and The Motherhood. All opinions

are completely my own.

Have you ever found yourself saying, “I could never afford a vacation?” What about, “I’ll never be able to afford my own home.” There’s also, “I could never afford to pay someone to clean my house.” And so many other ways to complete the sentence, “I could never afford…” What if I told you that there was someone who had less than $20,000 a year to work with for four years out of 20, while also supporting a large family that grew to include nine children who could also payoff two separate houses, become debt-free, pay out of pocket for seven years of college, and then build their dream home in the midst of it…would you believe me? Well, you should because that someone is me, and I’m here to say that it is totally possible. The truth is, it is totally possible to have more of the things you want in life. Although it so often is, money doesn’t have to be the limiting factor that is standing in the way of you accomplishing all those dreams and goals you’ve always thought were only for “other people.” Those dreams, your dreams, are totally possible. I’m here to show you some simple steps you can follow to start having more of the things you want in life finally within your reach, starting today.

Honestly, before you can even begin taking these steps, it starts with your mindset.

Here are a few truths to understand before you can start making your dreams come true.

Nearly everyone struggles

I know sometimes it’s easy to think that some people just have it easier than you do. But the truth is, that’s likely not the case. The difference between those who are making a life they love and those who aren’t is how they manage the struggles that come their way.

In order to have more of what you want in life, you must be someone who can pivot, adjust, make new plans, see failure as an opportunity, embrace scary things, take risks, and more. When you can do these sorts of things, you will be able to weather the storms of life as they come your way.

The past is in the past

No matter your money situation, today is a new opportunity to move in a different direction. The past doesn’t have to dictate your future. And, the past can even teach you so much about how to do things differently so that you’ll experience a different result.

You have to believe it first

If you want to live your best life, you must believe that you can live your best life. You must believe that you’re capable of doing new things. And, you must believe that you deserve and are worthy of all the amazing things you see others doing.

Before you can have more of what you want in life, you have to believe that this dream life of yours is worth fighting for.

If you don’t, you’ll likely forever stay stuck right where you are, feeling like you’re always on the outside looking in.

Now with that out of the way, let’s talk about how you can start having more of the things you want in life, even if you’re nearly broke.

Know where you’re spending your money

This isn’t really so much about having a budget as it is a clear snapshot of exactly where you are. A budget is an educated prediction and game plan, but before you can create a budget you really have to know where you’re at.

Where did all your money go last month? Where did it go for the past three months? What debt do you owe?

This is all part of creating a clear money picture, and that comes first.

For my husband and I, we spent, and spent, and spent for the first couple of years we were married. We had some cool stuff, but other than the stuff we had no idea where our money went.

We learned quickly that it is so important to track your spending – anything going out needs to be accounted for.

Where are you spending too much money?

Take an honest look at your money picture. Where are you honestly spending too much? Did you know that groceries are either the number one or number two expense in most families? Most people are spending more on food than they are on anything else in a given month.

Take an honest look at where you know you’re spending too much money.

One of the places we decided we were spending way too much money on was eating out, all our entertainment, and groceries. Now, we spend a lot less on these things.

We also bought a brand-new truck. It was awesome, but we went into debt to buy it. These days, we’ve learned the value in saving for and paying for cars outright.

Then, you’ll be ready for the next step.

Create goals

What is it you’re saving for? What exactly are the things you want in life that have always felt out of reach?

Sometimes it’s effective to write these things out in words, and other times you might find it more effective to clip some pictures that represent what you’re working for.

At times I’ve had a picture of a vacation spot or even the blueprints of our future dream home hung on my office wall. These things were a great representation of what I was working so hard for. And with these, it makes it easier to make the hard decisions and sacrifices sometimes.

We wanted to be debt free, and we also wanted to build a dream home that would fit our large family.

And, we did.

These days, we also want to make fun family memories with our kids.

While this is how we choose to spend much of our extra money, you might want to spend your extra money a different way.

Articulating your goals will help you set a clear ending point for your life and money.

Turn these goals into action steps

There really isn’t anything actionable about a goal. But, you’ve got to take the step to turn your goal into some action steps you can start taking right away.

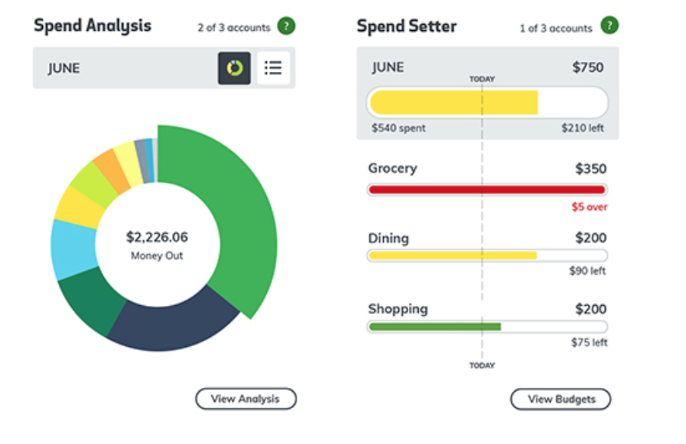

Huntington Bank has a few awesome tools to help you do that. Within The Hub, you can use tools such as the Spend Analysis and the Spend Setter℠ to help you visually see where you’re going and then track your progress along the way.

With these tools, seeing your progress has never been so easy, and it is in tracking your progress that you find even more motivation to work even harder at making your dreams and goals happen.

Stay on top of your spending

Revisit your money picture (things like your budget, your actual spending, and so on) often. Because money is fluid and life is fluid, it’s important to keep up on where you are and where you’re going. Life happens, plans change, roadblocks appear. You have to be able to see all of these things on a regular basis and as they are happening.

It becomes even easier to make sure you’re not losing track of your spending when you sign up to receive Huntington Heads Up® alerts (as always, message and data rates may apply). These alerts will let you know when you’re getting close to reaching the spending limits you’ve set for yourself. That way, you don’t accidentally overspend.

Money can be more of a struggle for you if you’re not making managing your money an ongoing thing. This means that if you’re ready to start living life more on your terms, now is the perfect time to take action with your finances.

I mentioned in the very beginning that one of the main differences between those who are living their dreams and those who can’t seem to make things happen is their ability to adjust to the ebb and flow of life.

With the tools from Huntington Bank, you can easily see where you’re at and how you can still make your dream life happen in the midst of where life takes you.

It really is possible to have more of what you want in life. It just takes a solid strategy and a simple step by step process to get things started and keep you on track moving forward.

You got this!