Are You Throwing Your Money Away? The Secret to Having More Money

The Intentional Mom Planning System is where you need to start with our incredible collection of product options. It will help you establish the basics for your life & home so you’ll finally have a plan, save yourself time, and go to bed feeling like you accomplished something every day (because you did). Save up to 60% HERE!

No one really would throw their money away on purpose, however, it can totally happen if you are unaware of some of the ways that your money is slipping through your fingers. Generally, the things I’m going to share with you here are not huge expenses as they stand alone. However, if you add all of these little things together, you can be throwing away hundreds and even thousands of dollars without knowing. So many people are throwing money away without knowing it. Let’s make sure it’s not you!

As I work with clients on personal life coaching appointments, many of these things are money suckers that are discovered as we work on creating a budget.

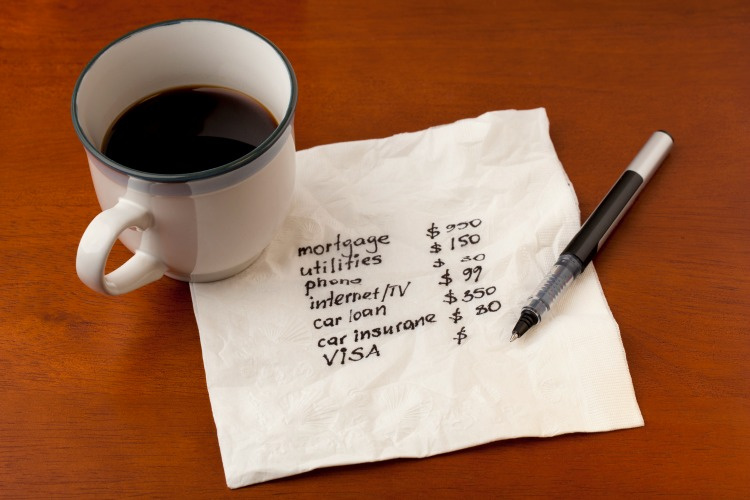

Budgets are one of those things that often overwhelm people. For that reason, I feel it is something that people need to do first when it comes to doing anything with their money.

Before you go any further, be sure to join our 5 Day Budget Bootcamp. You’ll have a budget you can work with in just five days! Enter your email below and we’ll get started!

[convertkit form=5048020]

The thing is, it is in working through creating a budget that you will best discover if you’re throwing your money away on any of these things. After all, you have to know where your money is going, right?

If you find yourself guilty of some of these, no worries, you are in good company. All of these are common struggles among many. Once you create your budget so you know where all your money is going, just make some changes going forward.

So, are you throwing your money away?

Let’s find out!

(this post may contain affiliate links. If you make a purchase, I may receive a small commission at no cost to you)

Throwing money away by not having a budget

If you don’t have a budget, your money is controlling you rather than you controlling your money. Have you ever realized this?

Who do you think can control your money better…you or no one?

As I’m sure you already know, you would do a better job.

Therefore, the lack of having a budget is also knowing that no one is controlling your hard-earned money.

Not even you!

So, let me help you create your budget HERE and let’s get to it!

Throwing money away by paying late penalties

This idea covers everything from late fees on movies to not taking advantage of early payment discounts. Paying interest on credit cards, and paying to keep Redbox movies longer.

Throwing money away by not shopping at the right time

Both grocery and non-grocery items follow the same basic cycles of what goes on sale when every year. Clothing becomes dirt cheap when transitioning from one season to another. When there is overstock on items you can get them for pennies on the dollar.

Check out The Sale Calendar of Groceries Throughout the Year and The Best Time of Year to Buy Nearly Everything.

It’s amazing how nearly everything that you buy has prices that vary by season and time of the year. And, they follow the same patterns every year.

Throwing money away by not reading reviews

Reading reviews is the best way of knowing what you’re getting before you purchase it. With the beauty of the Internet, you can know that something is a huge waste of money without having to find that out the hard way. You have the ability to read about nearly anything on Amazon these days. If you don’t, you just might be throwing your money away.

Even if you don’t end up buying the item on Amazon, it is generally a way to read some pretty honest reviews.

Throwing money away by not spending less when income decreases

When you continue spending as you always have when your income can no longer support it, it means that you’ll have no choice but to pay interest, late fees, and other penalties because the money just won’t be there. A large part of responsible money management skills includes living on less than you make, including times when your income takes a nose dive.

We would all love to have the income we need coming in all the time. But for most of us, there will come a time when you have to make it work with less than what you have had in the past.

Live on less than you make, whatever that is.

Throwing money away by increasing your spending as your income increases

Did you get a pay raise? Great! Don’t feel like you have to go out and spend it as though it’s burning a hole in your pocket. Save some of that hard earned money whether it is to put it in a savings account or to collect for an unexpected expense.

Having more money that you need is a very nice problem to have. But, being smart with your money means that saving for “a rainy day” is necessary.

Throwing money away by paying for more than you need

Maybe you’ve got a cell phone plan that is more than you need, a cable plan that you don’t really need, or heating vents open in rooms that you don’t use in your house. These would all be examples of paying for more than you need.

What can you get by with while still living comfortably? This is a question worth asking yourself in so many areas.

And, it’s important to answer this question honestly.

Living within your means and not throwing money away means that sometimes you might have to hurt a little.

Throwing money away by buying everything new

There are so many ways you can get used things these days including online and in-person shopping. Sometimes, you can even find “used” things to buy that are actually new. I cannot tell you the number of times that I’ve gotten clothes with the tags still on from a consignment shop.

Buying things used isn’t nearly as scary as it used to be. In fact, it can be a very rewarding treasure hunt!

I actually like making it a challenge to find used when I have to buy something.

Throwing money away by not repairing things

Don’t rush out and buy new right when something breaks. Take some time to investigate it first. There are so many things that turn out to be an easy fix with just a little time and effort invested. After all, we have no choice but to pay for so many things.

If you can get by at times rather than running right out to grab replacement items, you can avoid throwing money away unnecessarily.

Make it, make due, or do without is one of our family mottos. And it is a great one to live by.

Throwing money away by impulse buying

I can be so guilty of this at times. It is great to have a waiting period before buying most of the things you buy. There’s a reason why the checkout lane at Target looks like it does.

Most people are a sucker for the impulse buy that they just can’t live without so if this is you, too, you are not alone.

Here’s one great way to think about something before you buy it – think of it like your “impulse buy filter.”

Unless you came to the store for it, I’m guessing you can live without it and shouldn’t be throwing your money away with it.

Money is tight for so many people these days – myself included. For this reason, be sure that you are not throwing any of it away!

![Freezer Staples Needed In Times of Emergency [or Crisis]](https://www.theintentionalmom.com/wp-content/uploads/2017/05/freezer-staples-you-need.jpg)

I love the tips you share here. Budgeting is something that I do every month, without a budget my money would not work for me.

Its easy to save and achieve saving goals with a budget.

I also agree with you on reading reviews before making any purchase. This has certainly helped me to avoid those disastrous purchases.

Having a budget really is one of those essential money building blocks, isn’t it…thanks for reading!